What Is 401k Max For 2025 - Free 401(k) Calculator Google Sheets and Excel Template, Starting in 2025, employees can contribute up to $23,000 into their 401(k), 403(b), most 457 plans or the thrift savings plan for federal employees, the irs. People 50 and over can contribute an extra $7,500 to their 401 (k) plan in 2023 and. How The SECURE Act Changes Your Retirement Planning The Ugly Budget, Here's how the 401 (k) plan limits will change in 2025: The simple ira and simple 401 (k) contribution limits will increase from $15,500 in 2023 to $16,000 in 2025.

Free 401(k) Calculator Google Sheets and Excel Template, Starting in 2025, employees can contribute up to $23,000 into their 401(k), 403(b), most 457 plans or the thrift savings plan for federal employees, the irs. People 50 and over can contribute an extra $7,500 to their 401 (k) plan in 2023 and.

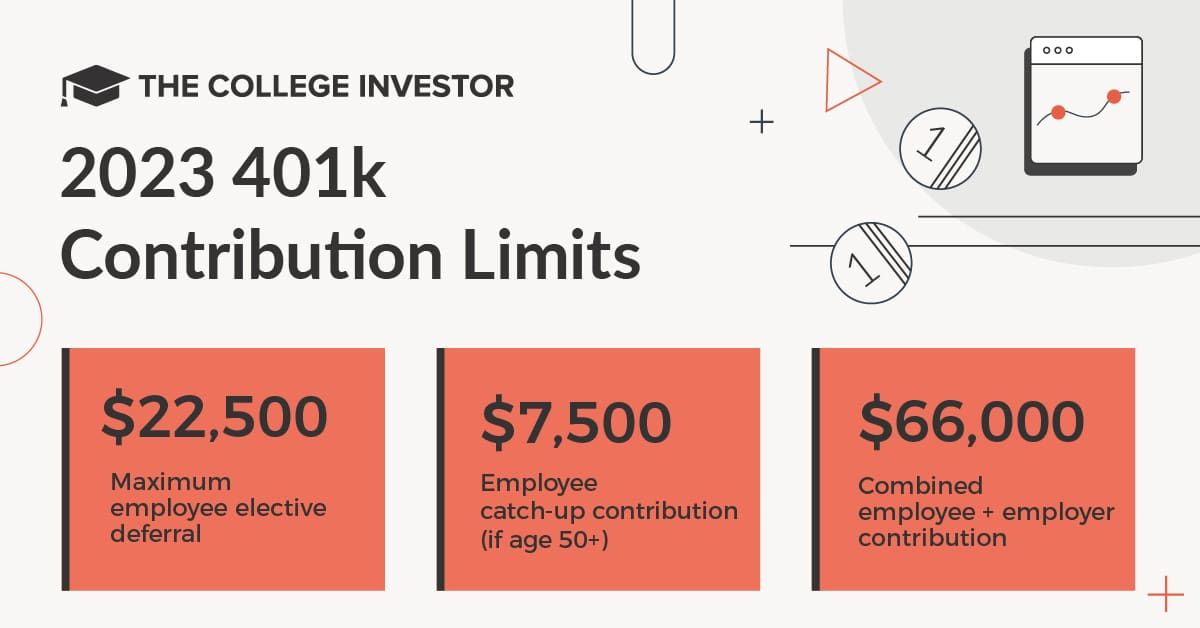

What Are the Maximum 401(k) Contribution Limits? GOBankingRates, In 2025, employers and employees together can contribute up to $69,000, up from a limit of. People 50 and over can contribute an extra $7,500 to their 401 (k) plan in 2023 and.

Emergency fund (enough to cover insurance deductibles) 2.

Significant HSA Contribution Limit Increase for 2025, The dollar limitations for retirement plans and certain other dollar limitations. People 50 and over can contribute an extra $7,500 to their 401 (k) plan in 2023 and.

What Is 401k Max For 2025. Here's how the 401 (k) plan limits will change in 2025: The 2025 401 (k) contribution limit is $23,000 for people under 50, up from $22,500 in 2023.

The 401(k) contribution limit for 2025 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions.

For the year 2025, the employee contribution limit for 401k and 403 (b) accounts will increase to $23,000 for individuals under 50 years old.

401k 2025 Contribution Limit Chart, The 2025 401 (k) contribution limit is $23,000 for people under 50, up from $22,500 in 2023. But one of the advantages of being 50 or older is that you can also make.

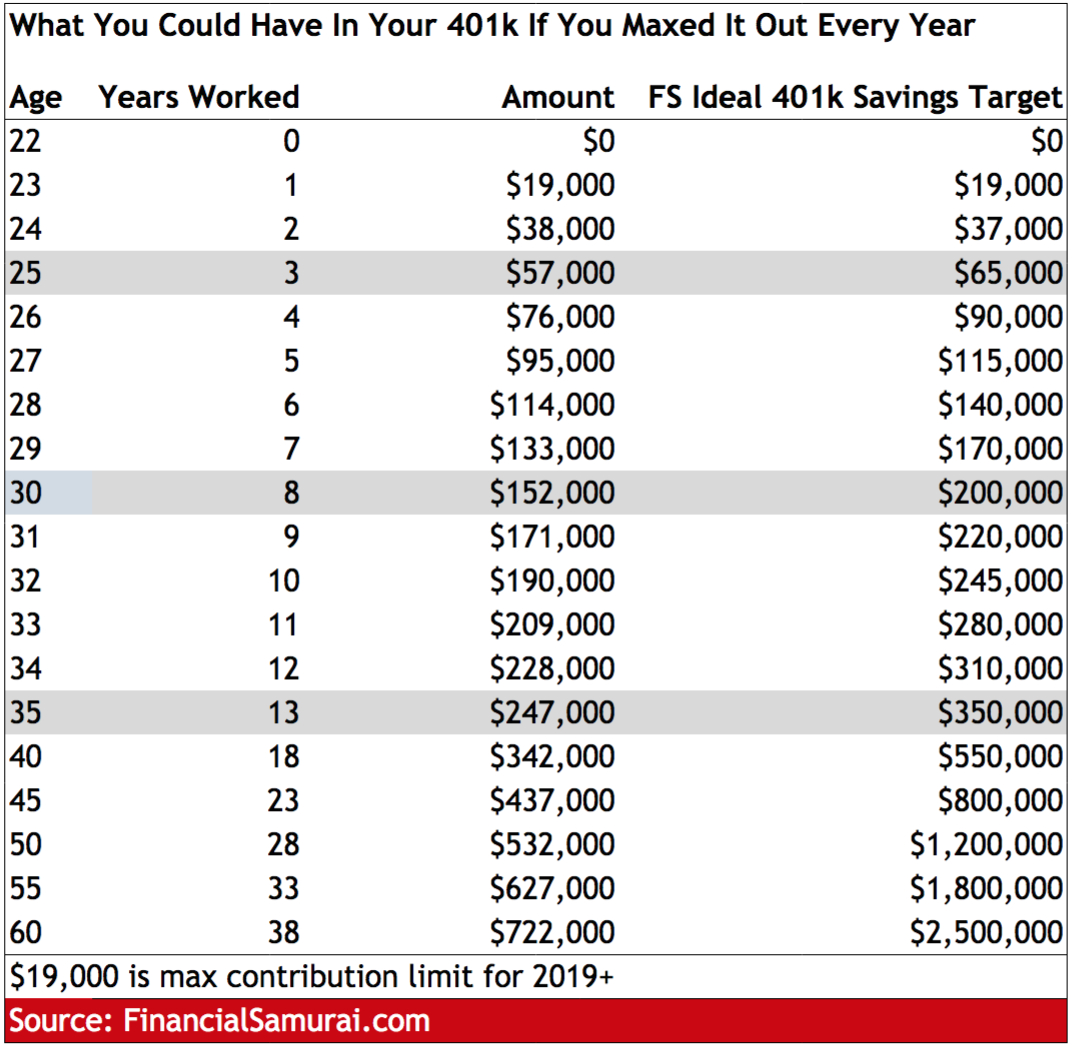

Maxing out your 401 (k) means contributing up to your annual contribution limit for the year. You can contribute to more than one.

40 Passive Revenue Concepts For 2023 To Construct Actual Wealth https, 2025 health savings account (hsa) contribution. The simple ira and simple 401 (k) contribution limits will increase from $15,500 in 2023 to $16,000 in 2025.

401(k) Contribution Limits in 2023 Meld Financial, Here's how the 401 (k) plan limits will change in 2025: If you’re 50 or older, you’ll be.